The fraud analysis card is an essential tool to let merchants know when an order is marked low, medium, or high risk. It helps merchants make a better decision on whether to fulfill an order or cancel it entirely.

My Role

Hey there, this is the default text for a new paragraph. Feel free to edit this paragraph by clicking on the yellow edit icon. After you are done just click on the yellow checkmark button on the top right. Have Fun!

Team and duration

Hey there, this is the default text for a new paragraph. Feel free to edit this paragraph by clicking on the yellow edit icon. After you are done just click on the yellow checkmark button on the top right. Have Fun!

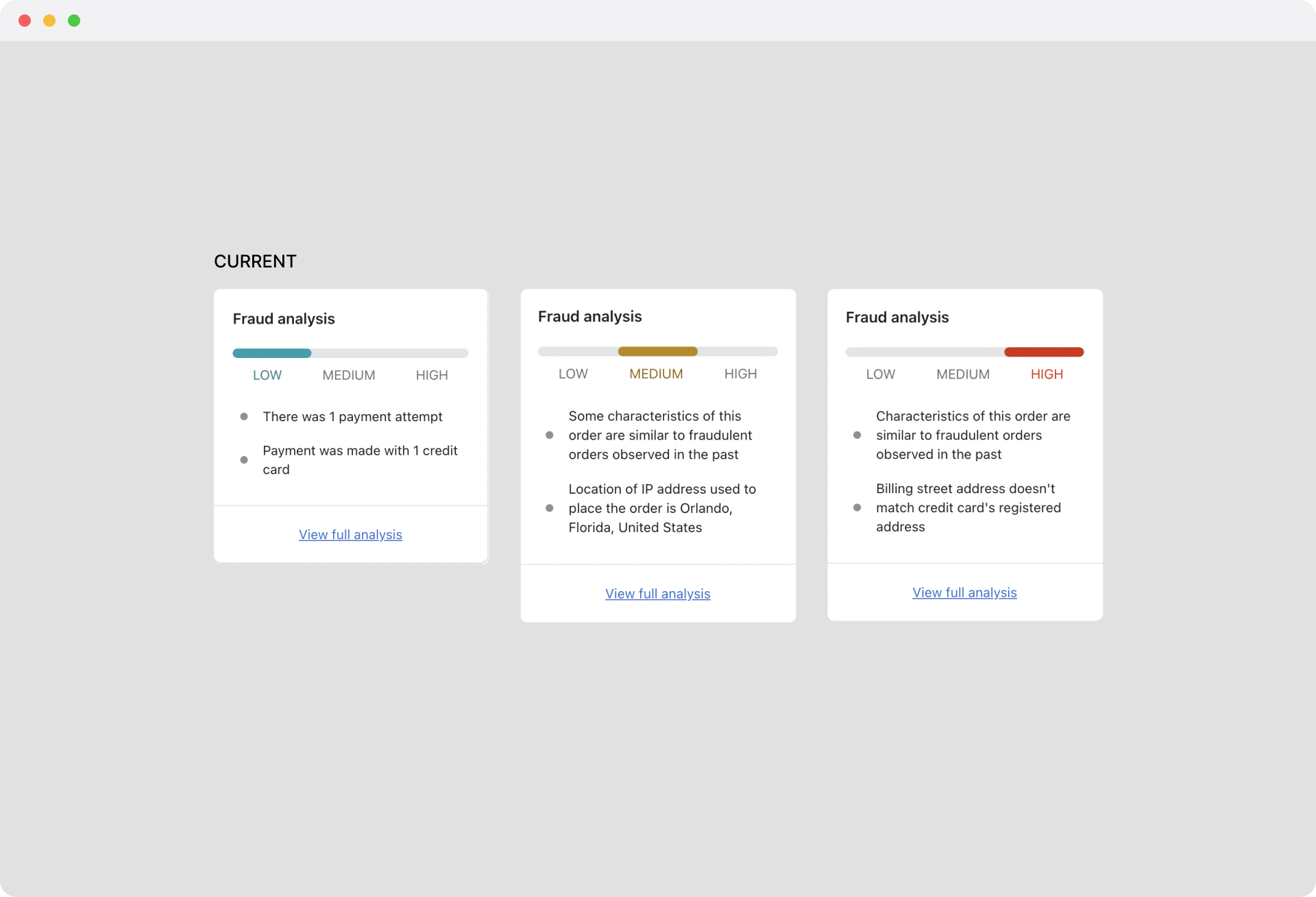

Fraud analysis is too vague. They would like something more specific than "Characteristics of this order are similar to fraudulent orders observed in the past"

Shopify Merchant

What problem are we solving

Looking at the fraud analysis card does not serve a meaningful purpose for the merchant. The indicators are often inconsistent and utterly uncorrelated to the risk level we show them. We don’t do an excellent job of explaining why an order is marked as high-risk. No two high-risk orders are the same. Merchants have low trust in our fraud analysis and must validate by contacting the buyer when an order is marked as high risk.

Furthermore, we heard through research that the fraud analysis card is vague, and merchants want more data-centric information. We want to start gaining trust regarding fraud/risk and Shopify. The fraud analysis has not been touched for three years, and it’s time for an upgrade!

When fraud is triggered due to “Characteristics of this order are similar to fraudulent orders observed in the past”, they'd like this message to expand on what characteristics are similar to fraudulent orders, so that they know what to refer to when contacting customers.

Shopify Merchant

Our approach

We want to build trust with merchants and be clear and explicit about why we marked the order low, medium, or high. Being vague might have worked in the past, but now merchants want direct information that would help them make better decisions.

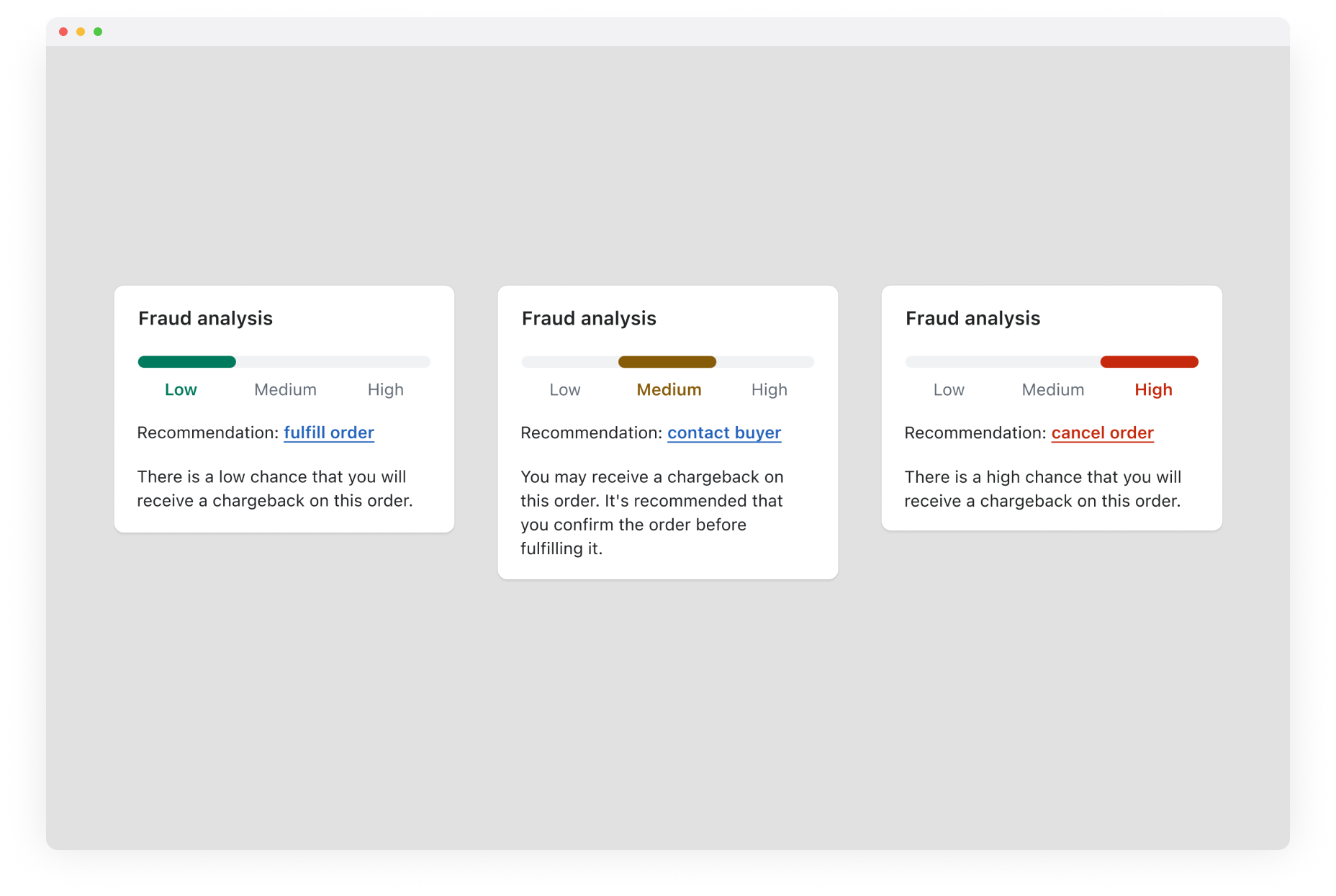

Recommended steps

Merchants are making their own decisions when it comes to fraud. What if we recommend what they need to do? For example, if an order is marked at high risk, we advise them not to fulfill it and refund it before they potentially receive a chargeback.

Be clear on the risk assessments

Re-evaluate the risk assessment categories and be more clear on the indicators. Currently, orders that have no risk are marked as low risk. We can introduce a new risk assessment category, such as “none,” rather than making the order “low” by details. Making the indicators more transparent and relevant will help merchants understand the fraud analysis card. For instance, merchants simply don’t know what "Characteristics of this order are similar to fraudulent orders observed in the past" means.

Share more data

This is an obvious one. One theme we repeatedly hear when we talk to merchants is that they want to see more data on risk.

They want to see the risk score of an order. What exactly makes the order high-risk? This is an opportunity for us to share data that can be relevant for their store. We have buyer data around the admin; collectively, we can tell if the buyer is a good or bad actor.

Context-aware fraud analysis card

We can better explain why an order is marked as none, low, medium, or high. For example, an order paid for using PayPal includes PayPal’s seller protection. In this instance, it is safe to say that the order is safe to fulfill without any risk, and orders that pass 3D Secure have no risk; including this type of information will allow us to be much more precise in the fraud analysis card.

The results

Fraud Analysis card

14%

High risk cancellation rate per shop

26%

Views for high risk orders

© Elushika Weerakoon 2024 / Product Designer / elushika@gmail.com